Cool Winter Eyeshadow Palette: Your Blueprint to Stunning Eyes

November 25, 2024

Light Spring Celebrities: An Expert Breakdown

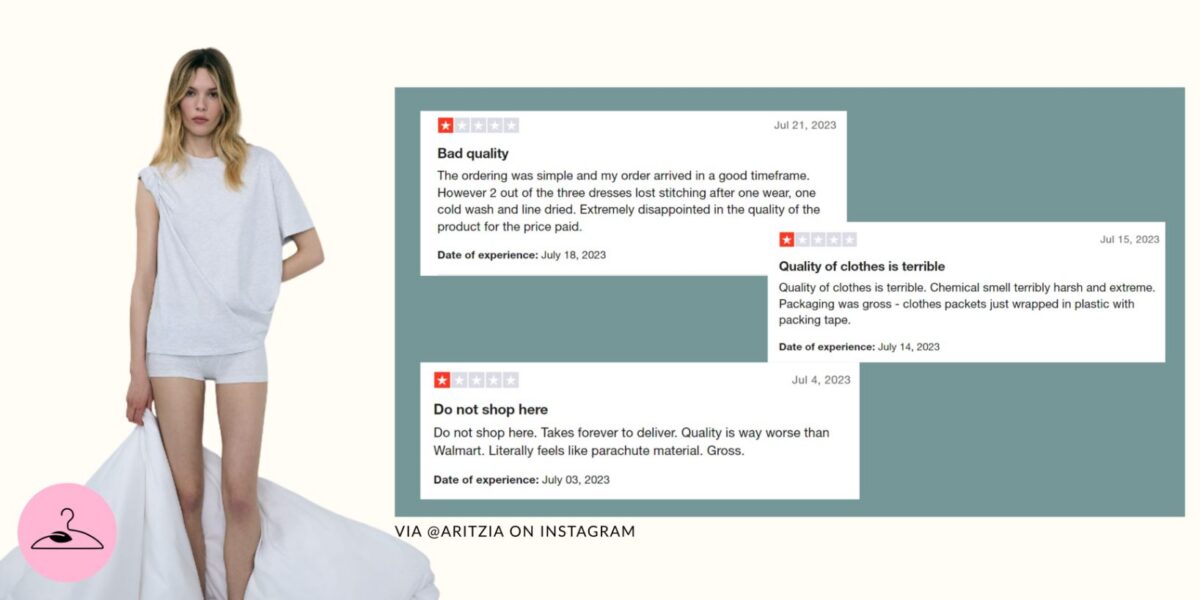

January 2, 2025Aritzia, a popular Canadian fashion brand, has made public claims about its commitment to sustainability and working towards a more eco-friendly future. But, given its practices and materials, many consumers are left wondering: Is Aritzia just another fast fashion brand? In this guide, we’ll examine the Aritzia’s sustainability claims, questioning whether they truly align with the brand’s actions — or if it’s simply greenwashing.

Is Aritzia Fast Fashion?

Aritzia is a premium brand that aims to offer “Everyday Luxury” – stylish, high-quality products in aspirational stores. However, it has been criticized for perpetuating the fast fashion model. The brand relies heavily on synthetic materials, overproduction, and questionable claims about sustainability, all of which are hallmarks of fast fashion.

Aritzia’s Sustainability at a Glance

| Indicator | Evidence | Assessment |

|---|---|---|

| Transparency | Minimal supply-chain disclosure; low Fashion Transparency Index score | ❌ Very Low Transparency |

| Labor & Ethics | No verified third-party audits; unclear factory conditions in China, Vietnam, Turkey, Romania, and Cambodia | ❌ Poor Labor Practices |

| Materials & Environment | Heavy reliance on synthetics, increasing polyester/nylon use year over year | ❌ High Environmental Impact |

| Production Model | Trend-driven collections, high-volume replenishments, influencer-driven sales | ❌ Fast Fashion Production |

Aritzia Relies Heavily on Synthetic Materials

Aritzia’s fabric choices raise significant sustainability concerns. While the brand uses a mix of natural, synthetic, and animal-derived materials, the majority of its garments are made from synthetic fabrics such as lyocell, viscose, polyester, and modal. According to Aritzia’s FY2023 ESG Sustainability Report:

- Synthetic fiber use increased from 36% to 44% between 2021 and 2022

- Cotton use dropped from 39% to 32%

- Animal-derived materials decreased from 16% to 12%

The overarching pattern here is evident: Aritzia is steadily reducing its reliance on natural fabrics while expanding its use of non-biodegradable synthetics.

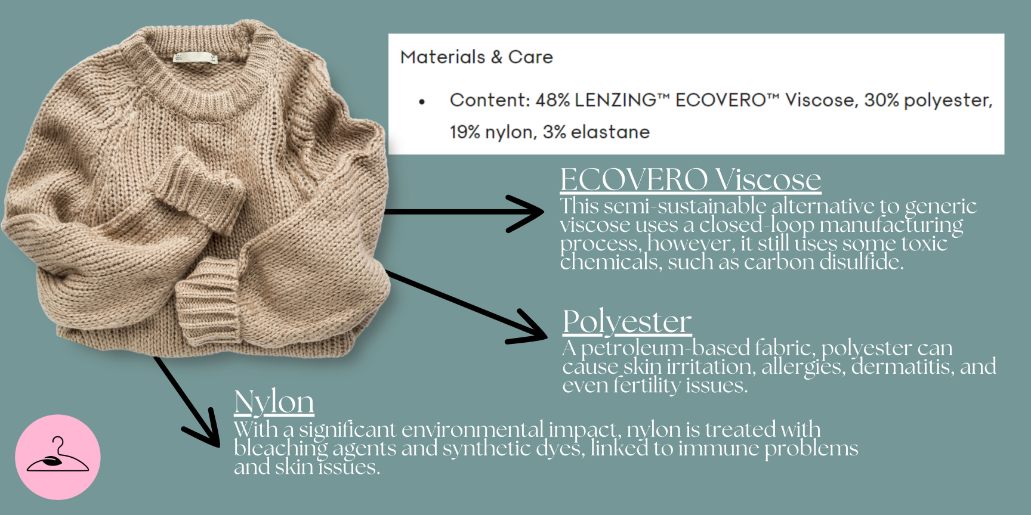

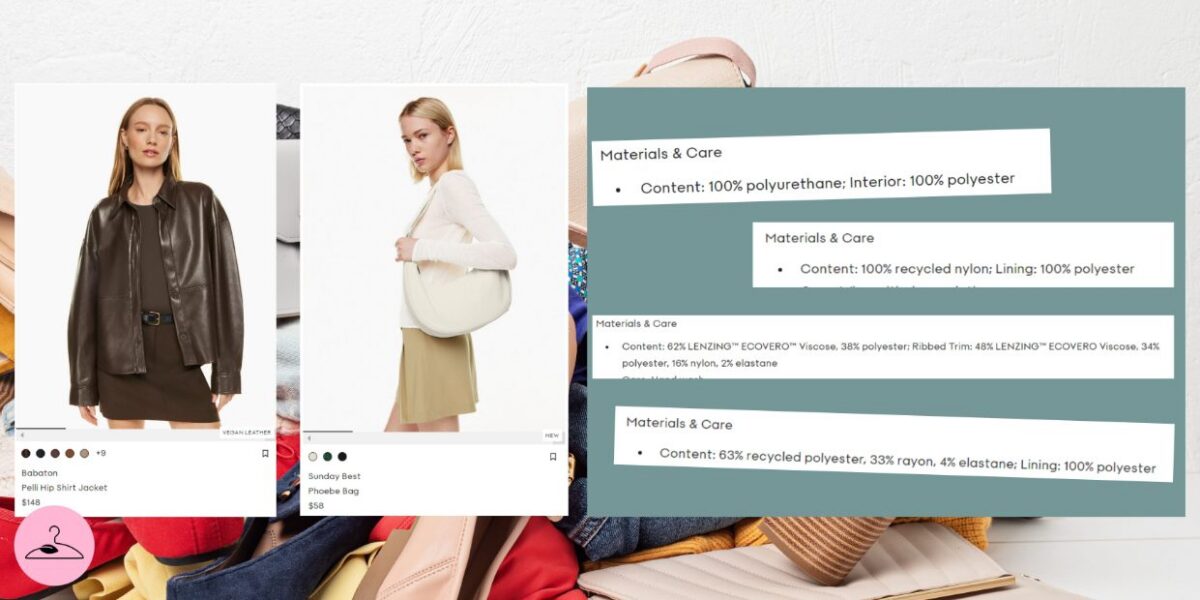

A practical example of this is a typical Aritzia sweater, which may include a semi-synthetic fiber like ECOVERO™ viscose blended with virgin synthetics such as polyester, nylon, and elastane. These blends help achieve certain fits and finishes but rely on fossil-based production and contribute to long-term material persistence, including microfiber shedding during washing.

Does Aritzia Use Ethical Fabrics?

Aritzia highlights several sustainability initiatives, but many of these efforts contrast with its broader material choices. The brand often points to milestones like its 2010 fur ban and its 2024 decision to eliminate angora and mohair – moves that sound meaningful on paper. However, these efforts have limited overall impact, especially since these fibers can be responsibly sourced and make up a small share of Aritzia’s materials.

The brand also promotes its participation in the Good Cashmere Standard, noting that 52% of its Fall/Winter 2022 cashmere was certified responsible. However, responsible cashmere represents just 4% of Aritzia’s total animal-derived materials, and animal fibers overall account for only 12% of its collection – meaning these ethical initiatives touch a relatively small portion of its inventory.

Ultimately, Aritzia continues to rely heavily on rayon, viscose, polyester, and other synthetics, which raises questions about how closely its sustainability messaging aligns with its actual practices.

How Aritzia Sources Wool, Down, and Other Animal Fibers

A similar pattern appears with Aritzia’s Responsible Wool Standard (RWS) and Responsible Down Standard (RDS) programs. RWS-certified wool makes up only 2% of its animal fiber use, while roughly 72% of its wool products rely on conventional wool -including merino. Responsible down adoption is also minimal.

Clearly, Aritzia needs to address the sourcing of the majority of its animal-based fabrics. However, the brand has postponed this goal, aiming to make all its animal-derived materials responsible by FY2027.

Aritzia’s Labor Practices and Supply Chain Transparency

Aritzia often highlights its partnerships with the Sustainable Apparel Coalition, the Better Cotton Initiative, the Better Work program, and the Textile Exchange. On paper, these affiliations paint a picture of a brand leaning toward ethical progress, almost as if Aritzia is assembling all the right puzzle pieces. But when you look closer, the puzzle never quite comes together.

Aritzia Mentions Ethical Initiatives, But Provides Little Proof

Behind the scenes, Aritzia produces its clothing through suppliers in Vietnam, Turkey, Romania, Cambodia, and China. These regions are home to many skilled garment factories, but Aritzia reveals very little about the actual conditions inside the facilities it uses. There are no detailed factory lists, no public wage data, and no third-party audits to help verify the brand’s claims. So, while Aritzia promises to steer clear of areas linked to forced or child labor, consumers are ultimately asked to take this on trust.

Only a small fraction of Aritzia’s suppliers participates in recognized labor-standards programs, leaving most of its manufacturing footprint largely unexplained. It’s no surprise, then, that external evaluators, such as Good On You, rate the brand’s labor efforts as “Not Good Enough,” citing a lack of transparency and no clear commitment to paying living wages.

In short, Aritzia talks about ethical labor in broad strokes, and perhaps even with good intentions. But without concrete disclosure or verified oversight, the story remains incomplete — and that uncertainty echoes the same concerns raised about many modern fast-fashion brands.

Aritzia’s Positive Community-Building Initiatives

In 2020, Aritzia announced a donation of a thousand of their signature Super Puff jackets to underprivileged Canadian women and adolescent girls during winter holidays. The campaign was a part of the brand’s Community Giving Program, which empowers the local community suffering from socioeconomic obstacles.

Overall, the brand has donated over 100k garments to Union Gospel Mission, impacting women struggling with homelessness in Vancouver, Canada. What’s more, Aritzia has donated $60 million worth of products through Aritzia Community partners, assisting more than 700k people. As a result, Aritzia received a recognition from the Retail Council of Canada for the Excellence in Retail Philanthropy Award.

A Failing Sustainability Mission?

Aritzia’s 2025 sustainability report states that the brand continues to offset 100% of its Scope 1 emissions and purchases Renewable Energy Certificates for all Scope 2 emissions, maintaining carbon neutrality across its direct operations since 2022. However, these offsets do not reflect actual emissions reductions. Scope 3 emissions (which represent the bulk of Aritzia’s environmental footprint) have continued to rise, and the brand has not yet disclosed specific science-based reduction targets or a net-zero plan.

Transparency shows little improvement, too. Aritzia’s Fashion Transparency Index score remains stalled at 21–30%, and watchdogs like Good On You still rate the brand “Not Good Enough.” With synthetic material use increasing from 36% to 44% between 2021 and 2023, Aritzia’s sustainability progress appears limited, raising concerns about the gap between its marketing and measurable impact.

Aritzia’s Vision for the Future

Based on its sustainability vision, Aritzia seems to strive towards going green. It has signed on to set science-based emissions targets within the next two years. This seemingly bold pledge comes as a part of the brand’s partnership with the Science Based Targets initiative – a global effort helping companies transition to a net-zero economy.

Does this initiative mean that Aritzia will walk the walk, beyond just talk? Well, not necessarily. The brand’s target-setting process is now incomplete. However, even if it was put in place, the SBTi itself raises many questions about its validity.

As in the case of a fast fashion brand, Guess, many retailers join the industry’s efforts to reduce emissions, aiming to keep global warming below 1.5C, which aligns with the Paris Agreement objectives. Yet, the SBTi group faces criticism from experts due to several reasons, such as:

- charging retailers a fee for accreditation (indicating its potentially commercial motives)

- not having a large validating team

- giving retailers a free hand to modify and set their targets via questionable tools

Fashionable Minimalism or Just Clever Marketing?

Aritzia’s style focuses on simple, minimalist designs in neutral colors like white, beige, gray, and black. This clean aesthetic gives the impression that the brand values sustainability and makes high-quality, long-lasting products.

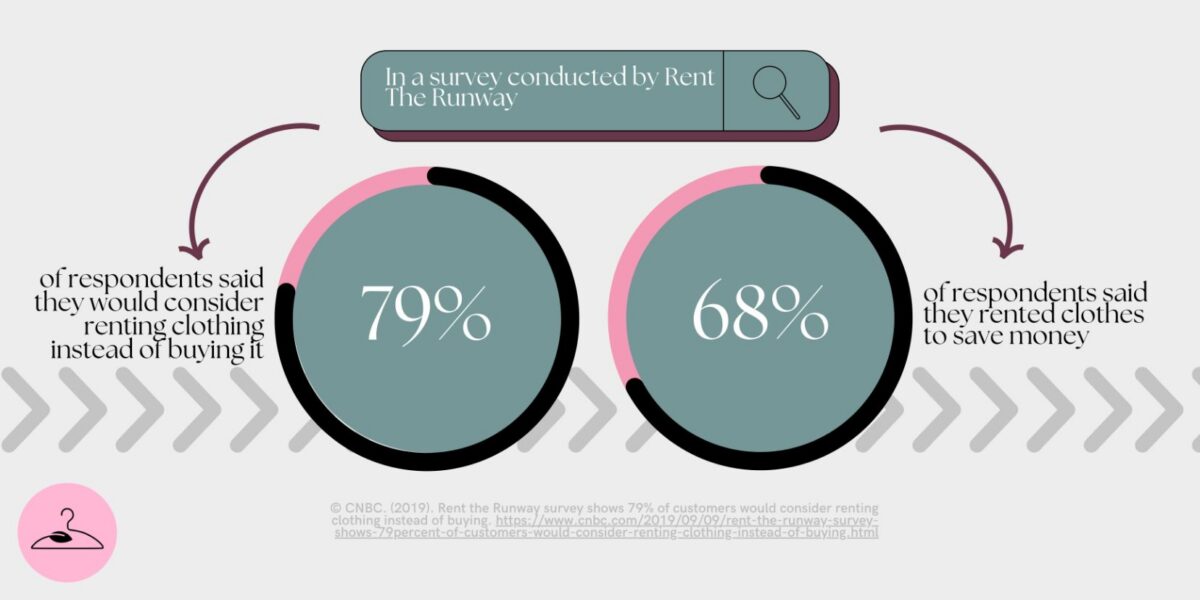

Despite promoting the idea of buying “fewer, better pieces,” Aritzia relies on a modern engine behind consumerism in fast fashion: influencer marketing. High-profile endorsements — like Kendall Jenner showcasing her Super Puff to an audience of over 100 million — help drive demand in the same way fast fashion brands have for years. Fashion Nova famously skyrocketed using this strategy, and Aritzia appears to follow a similar playbook, encouraging frequent purchasing through trend-driven visibility rather than long-term durability.

Aritzia’s Aesthetic Suggests Sustainability, but Its Practices Don’t Reflect It

However, in fashion, actions speak louder than words. Aritzia’s simple designs may look eco-friendly, but the brand doesn’t have the evidence to back up its aesthetic facade. Instead, Aritzia mimics the look of sustainable labels without adopting the deeper commitments — such as robust supply-chain transparency or lower-impact materials — that truly define ethical fashion.

Ultimately, just because something is simple or expensive doesn’t mean it’s sustainable. Without real action, Aritzia’s minimalist designs are more about appearances than actual ethical practices.

A Brief History of Aritzia

The reason behind Aritzia’s popularity lies in its trendy brick-and-mortar stores. The retailer has been operating over 100 boutiques in Canada since its launch in 1984, as it has become one of Canada’s most popular brands ever since. It caters mostly to women through chic, elegant, and minimalistic mid-priced pieces, which are sold in the most unique, urban spots.

The brand relies heavily on physical stores, as its e-commerce sales only amount to the 33% of the total revenue. Like Mark Petrie mentions, Aritzia’s stores lay at the “intersection of value and quality”, which cultivates an inviting atmosphere, luring consumers to linger in the store for longer and purchase more clothing (either now or later, online).

Is Aritzia Fast Fashion? Our Final Verdict

Aritzia’s polished aesthetic crafts the impression of a brand moving toward sustainability, but its underlying practices tell a different story. With a heavy dependence on synthetic materials, limited supply-chain transparency, and a trend-driven production model, Aritzia aligns closely with fast fashion. Until the company offers clearer evidence of responsible sourcing and verified labor oversight, its sustainability narrative remains more aspirational than assured.

Frequently Asked Questions

Aritzia manufactures its clothing through suppliers in countries such as Vietnam, China, Turkey, Romania, and Cambodia. While these regions are major apparel hubs, the brand does not disclose detailed factory lists, wage information, or third-party audit data, making it difficult to assess working conditions or verify how responsibly its garments are produced.

Aritzia is not a traditional luxury brand, but rather a premium retailer positioned between fast fashion and contemporary labels. It appeals strongly to Gen Z and Millennial shoppers by offering minimalist, trend-forward clothing at prices higher than typical fast fashion, yet far below luxury designers, placing it firmly in the accessible “mid-luxury” category.

Aritzia’s pricing is considered expensive compared to many high-street retailers, largely due to costs associated with its boutique-style stores, curated in-person shopping experience, and premium branding. While the brand emphasizes quality, its prices often reflect retail overhead and marketing strategy rather than significantly superior materials or transparency in production.

Aritzia primarily targets Gen Z and Millennial women, especially those between 18 and 34 years old who gravitate toward minimalist, trend-forward styles. Although the brand has a small male customer base, its core audience consists of young women who value aesthetic-driven shopping experiences and aspirational fashion.

Consumers are drawn to Aritzia for its elegant store environments, carefully curated product displays, and elevated boutique atmosphere. The brand’s minimalist, stylish pieces offer a sense of attainable luxury, appealing to shoppers who enjoy fashionable basics and trend-driven items, even if sustainability is not their primary purchasing concern.